PIMS has been benchmarking lubricants and greases plant operations for over 30 years now. It helps clients to improve their operations and reduce costs by learning from appropriate comparisons.

Motivation:

Lubricants companies worldwide are facing a variety of challenges. Economic uncertainty coupled with increasing competitive pressure is forcing producers to re-examine all areas of their operations. Historically, there was pressure to increase market share, capacity and complexity. In regions where demand for many lubricants is falling, due to lengthened vehicle service intervals, companies prefer to make decisions and exercise control on the basis of external benchmarks. On the other hand, in regions where demand for lubricants is rising due to increasing economic development, companies focus on benchmarking to maintain (or achieve) the operational edge necessary to support competitive advantage and finally achieve market share growth and optimal capacity and complexity management.

Participants:

The PIMS database has recent data from most of the major players: Shell, ExxonMobil, BP, Chevron, Total, Sinopec, PetroChina, Statoil, Valvoline, ENI, RepsolYPF, Lubrisur, Kuwait, H&R, Scanlube, ConocoPhillips, Galp, PetroCanada, Orlen, Axel Christiernsson, OMV, MOL, Petrobras, Lukoil, Eko, Gulf, Idemitsu, ALMC, Irving, CHS and ADNOC.

Objectives:

To help clients’ plant management team to:

- capture comparable cost and performance metrics across different companies and countries

- measure the drivers that cause performance differences: scale, automation, product mix, complexity, service levels, distribution policy, location, processes, etc.

- quantify how performance is affected by these drivers

- set benchmarks that take account of each plant’s specific profile (i.e. the structural drivers that are unlikely to change)

- see results that ensure data confidentiality while setting benchmarks for cost and performance improvement

- implement recommended changes to achieve better profitability and growth

The Process:

Option 1) Two – yearly round

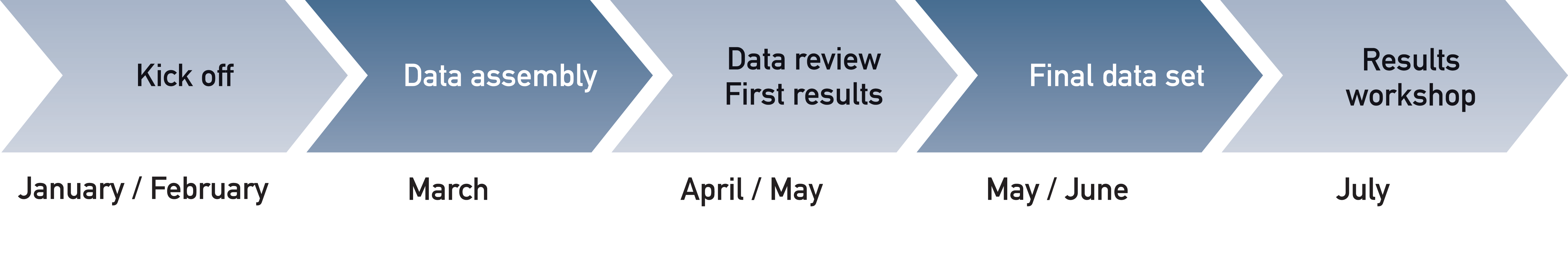

By joining the normal two-yearly benchmarking round the following project timeline is followed:

Data from every even numbered year is used in the benchmarking and thus the kick-off meeting occurs in January of every odd numbered year.

Option 2) Out-of-cycle benchmarking of a single plant

By benchmarking out-of-cycle PIMS consultants can work face-to-face on-site at each plant and HQ. By interviewing key plant personnel, and working with planners and financial accountants, we develop a comprehensive profile of your plant operations. In the normal course of events, over a 10 day period we can gather and review all necessary data, and prepare and present the findings. Your data will be benchmarked against the most recent set of data.

Inputs:

PIMS have developed a two page form which collects all the information necessary to produce a comprehensive set of benchmarks. This includes data on plant raw material receipt, lubricant blending, lubricant packing, grease production and packing, days lead time, laboratory, bulk filling and despatch, plant warehousing and loading, losses, energy, maintenance planning, health, environment and safety, and an overall plant breakdown of costs, people and assets.

Deliverables:

Delivery is undertaken by PIMS consultants (two at each meeting), who present the following:

1. A Data Appendix comprising:

- performance comparison against top quartile, median, and bottom quartile performance on a wide range of performance measures against the regional/country data sets. For production costs, PIMS drills down through a comprehensive waterfall linking cost per ton to operating metrics in each area of the plant measuring complexity, productivity, configuration, production planning, etc.

- “look-alike” comparison against the performance of the best plants that resemble your plant’s profile. We compare you against the performance of the best plants that resemble your plant’s profile. Look-alikes are the closest structural peers: based on your current profile (scale, product mix, complexity, labour cost environment and major “givens” for configuration, e.g. % of base oil in via pipe etc.). We match you with your peers in each activity area, and compare you with the best half (e.g. best four out of eight).

- local and regional comparisons against the best half of your closest geographical/market peers in each activity area (raw material receipt, blending, packing, laboratory, filling and despatch, warehousing, other production costs and assets, G&A, etc.). What are they doing differently and are they doing better? PIMS can amend the default definitions and boundaries of “local” areas to meet clients needs, so long as the number of “local” observations in the database can guarantee 100 % confidentiality.A Data Appendix comprising:

2. An Executive Summary concentrating on the issues requiring attention, and highlighting the level of potential savings that could be achieved if you moved towards the performance levels of the best practice “look-alikes”.

Future Scenarios:

The database can also be used to estimate the effect of planned changes on the operation of a plant. Possible changes in staff numbers/equipment productivity/product mix etc. can be compared against the database. This allows the effect of these changes to be seen when compared against the range

of plants in the benchmarking database.

As the world invents more and more different devices to lu-

bricate, with increasingly sophisticated requirements, new lubricants are developed to meet the diversifying needs. Other lubricant innovations are mandated by ever stricter health, safety, and environmental concerns. This inevitable increase in complexity represents both an opportunity and a challenge for lubricants manufacturers.

On the one hand, opportunities for differentiation and better margins are continually being created, while on the other hand the supply chain gets more complex and costly to manage.

Given all that, we still want a way of determining whether a plant is performing well, given the job it has to do and the location it is in. Just being “best quartile” on cost by eliminating all complexity (and all the margin) will not do. PIMS offers a reliable “cost efficiency index” based on actual versus structurally-expected costs, inventory levels, losses, etc.

Optimising the future by mending the present (following up your participation in our study)

PIMS Membership provides lubricants companies with access to the most comprehensive lubricants and greases information network in the world. Members can pose “what-if?” questions and commision customised research on the database.

PIMS has been benchmarking lubricants and greases plant operations for over 25+ years now and we have been very successful in helping our clients to improve their operations and reduce costs by learning from appropriate comparisons. PIMS Lubricants and Greases Benchmarking is gradually becoming an “industry standard” according to our clients.